$4,100 Georgia’s Tax Refund is Coming: As the rest of the country rushes to file income tax returns, Georgia residents still have until May 1, 2025, giving them two extra weeks. For many, this means a little extra time and, hopefully, a tax refund that brings some financial relief.

If you live in Georgia, you might be in luck—Georgia ranks sixth in the U.S. for average tax refunds, according to financial website Upgraded Points. While it may not be in the top five, the state offers competitive refund amounts, especially with recent changes in income tax rates and filing trends.

Georgia’s Tax Refund Landscape in 2025

Georgia’s tax landscape has seen some key changes this year. The state income tax rate was reduced from 5.49% to 5.39%, giving taxpayers a small break and potentially larger refunds. Also, the deadline to file 2024 taxes is May 1, 2025, providing some breathing room compared to the rest of the country.

Average Tax Refunds by Income Level

Tax refund amounts in Georgia differ depending on your income. Here’s what taxpayers typically receive:

- Income below $50,000: Average refund of around $2,400

- Income between $50,000 and $100,000: Refunds average $2,800

- Income between $100,000 and $200,000: Refunds go beyond $4,100 (though fewer people in this group qualify for refunds)

This trend shows that middle-income earners tend to get solid returns, while higher earners receive larger refunds, but not as consistently.

How Georgia Compares to Other States

Though Georgia ranks sixth, some other states offer even higher average refunds. Here are the top and bottom states:

Highest Refund States:

- Florida: $3,852

- Texas: $3,772

- Wyoming: $3,720

- Nevada: $3,643

- Louisiana: $3,577

Lowest Refund States:

- Maine: $2,656

- Wisconsin: $2,737

- Oregon: $2,772

- Vermont: $2,816

- West Virginia: $2,834

Southern and Mountain West states often top the list due to various tax structures and deductions.

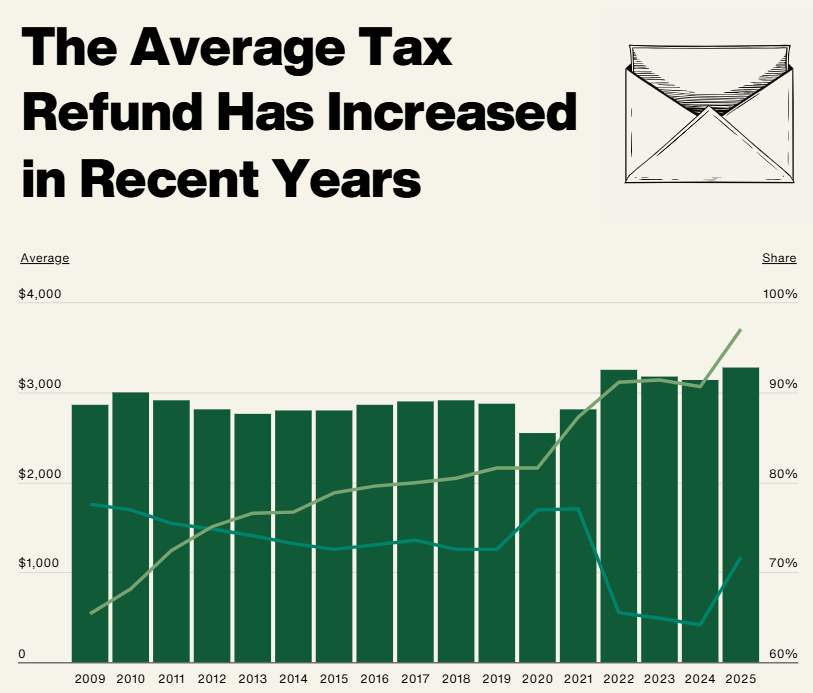

Most Georgians Prefer Direct Deposit

In Georgia, about 92% of tax refunds are sent via direct deposit, which is close to the national average of 97%. This method is faster, safer, and more reliable, helping taxpayers receive their refunds quickly—usually within three weeks. However, if your return has errors or needs extra checks, it could take up to 12 weeks. Paper checks usually take even longer.

What a Big Tax Refund Really Means

While getting a large refund can feel good, experts say it might mean you’ve paid too much tax during the year. Wiggam Law, a tax resolution firm in Atlanta, warns that “you could have done much more with that money” if you had adjusted your withholdings.

To avoid overpaying, consider checking your W-4 form and use the IRS Tax Withholding Estimator to see how much should be withheld from your paycheck.

If you’re a Georgia taxpayer, you’re in a good position for 2025. With an extended filing deadline, a lower state tax rate, and generous average refunds, now is a great time to file early and get your refund sooner. Just remember—a big refund isn’t always good news. Consider adjusting your tax withholdings for next year to keep more of your money throughout the year.

FAQ

When is the Georgia state income tax filing deadline in 2025?

The deadline to file Georgia income taxes in 2025 is May 1. If you request an extension, you have until October 15 to file.

What is the average tax refund in Georgia based on income?

Taxpayers earning under $50,000 receive about $2,400. Those earning $50,000–$100,000 get around $2,800. Higher earners between $100,000–$200,000 receive over $4,100, though fewer qualify.

How long does it take to receive a Georgia tax refund?

Most refunds are issued within three weeks if filed correctly with direct deposit. Refunds may take up to 12 weeks if there are errors or further checks.

Why do some states have higher refunds than others?

States with higher refunds, like Florida and Texas, may offer more tax benefits or lower state taxes. Refund amounts also depend on income and withholding.

Is a big tax refund a good thing?

Not always. A large refund means you paid more in taxes than needed. Adjusting your W-4 form can help you keep more of your money throughout the year.

How do most Georgia residents receive their tax refunds?

About 92% of Georgia taxpayers use direct deposit to receive their refunds, which is the fastest and most secure option.

Where can I check my Georgia refund status?

Visit the Georgia Department of Revenue’s official website to track your refund status or get help with filing.